By Paul Studebaker, Control editor in chief

“From pumps to farm equipment to automobiles, products are being reinvented to be responsive, learn and adapt.” Accenture’s Brian Irwin discussed the disruptive effects of digital technology on industry, and the new business models that are on the rise.

Industry is at the point on the digitalization adoption curve where we can definitely see the future and how some companies are succeeding, but most organizations have done little to adapt and capitalize on what they see coming. This deer-inthe-headlights moment is pivotal, and like that deer deciding whether and which way to jump, what many companies do now may well seal their fate.

We have no shortage of examples. “Imagine you manage a mid-sized food distribution company in California with a fleet of trucks, and buy somewhere between 300 and 30,000 tires each year,” said Brian Irwin, automotive and industrial lead, Accenture, in a presentation at Smart Industry 2018. “Yesterday, you bought those from a tire company. Today, Michelin offers tires as a service. Pay by the mile, and they will keep your fleet tired, the tires inflated and serviced.”

Now, Michelin offers EFFIFUEL, a service including low-rolling-resistance tires, telematics, maintenance and driver training. “Michelin is working on guaranteeing a 5-10% fuel consumption reduction for a price, based on tires and how the trucks are maintained and driven,” Irwin said. “It’s an outcome-based business model made possible by digital technology—big data, the cloud and mobile.”

This and similar examples, from Caterpillar’s remote monitoring of farm equipment to Black & Decker programmable power tools, represent “a tectonic shift, and not the first,” Irwin said. Industry 4.0 is here, and now, “Industry X.0 is coming, with connected products, connected customers and connected operations—a trifecta affecting the business model, and affecting virtually every industry. Virtually no business is safe from disruption.”

No refuge from disruption

Twenty-five years ago, people said, “Truck drivers would never be outsourced.” Today, we are seeing selfdriving trucks. “In shipping, 0-500 miles is done by truck, 500-2,000 miles by rail. An autonomous fleet of trucks can eat into the railroad industry’s business,” Irwin said.

The product remains the core, but, “From pumps to farm equipment to automobiles, products are being reinvented to be responsive, learn and adapt. And to collaborate, on platforms to communicate across an entire ecosystem, to hyper-personalize to the consumer, and adapt to provide the best experience,” Irwin said.

Consequently, the source of value is migrating, from 100% mechanical in the 1960s to a future where 70% of a product’s value will be digital. “Service and information are being provided via digitalization,” Irwin said. “Companies are struggling to adapt.” Accenture research shows that among all companies, 68% believe in doing something about digitalization, but only 16% have a vision, 5% are committed, and just 2% are executing. “Fifty percent believe artificial intelligence will affect products in five years,” Irwin said. “They say, ‘We believe it, but we haven’t figured it out.’” Key issues and questions are familiar everywhere, Irwin said. Among the comments he’s heard:

• “Our core business is no longer delivering the expected growth, others are capitalizing on our products.”

• “We’re not getting the right product out on time.”

• “Our supplier network has grown, but we see our product quality has decreased.”

• “Our warranty costs are increasing and we don’t have insight into the root cause.”

• “We need to move from prototype and into production faster.”

• “Industry X.0 addresses them all,” Irwin said. “It’s not a one-size-fits-all solution, but we are capable of delivering the answers.”

Five key trends

Irwin identified key areas where companies can find inspiration for their own efforts to digitalize. First is in new business models, for example, “AI as a service, like Michelin,” he said. Connecting assets, products, services and solutions using software and embedded intelligence to platforms and ecosystems is one way to escape commoditization and differentiate offerings. A second trend is to “drive innovation from the outside in,” Irwin said, by investing in incubators and acquisitions. “Expand ecosystem partners, and find a capability to grab onto,” he said. “Work with incubators or buy an option on finding a way to protect yourself against disruption.” Examples include Siemens’ Technology to Business program and GE’s HealthyImagination incubator. Third, provide a data-driven customer experience. “Harness the power of data to reinvent, centered on the customer,” Irwin said. ”Use analytics and applied intelligence to create new insights that drive value by improving the customer experience.” This is not a new principle, but new applications.

For example, pulling data off operating vehicles to understand how they’re driven is not new, but now insurance companies are doing it to tailor premiums to driving habits. A fourth trend is digitalization of enterprise processes. Accenture research shows that digitization could enable a typical industrial equipment manufacturer with an industry average $28B in revenue and $3.3B in EBITDA to add up to approximately $1.38B EBITDA by 2020.

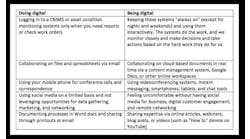

Finally, new operating models are bringing companies from traditional vertical silos to “fluid, balanced matrix models,” Irwin said. Instead of being organized end-to-end by product line or business group, they include flexibility for smaller product lines. They leverage horizontal capabilities, such as global business services and digital manufacturing. And they look to increase efficiencies and synergies while developing new businesses fast.

More digitalized products

Additional examples of companies digitalizing their products include Faurecia, which makes automotive seat sets. “What can seat guys do?” Irwin asked. “Detect the driver’s position to adjust the mirrors, set drowsiness or inattention alarms, increase comfort and safety. But a seat company knows foam, leather and steel, not electronics, so where can they get the money to invest? An IPO.” Smart Water makes faucets for the hospitality industry. “Users complain about showers,” Irwin said. “Sensors on pipes can help provide a better experience—pressure, temperature—and also detect leaks. 25% of water is lost to leaks.” A company in India has 13,000 coffee vending machines “running out of supplies,” Irwin said. “They connected the machines and work the supply chain around them.” Along with selling more coffee and reducing service costs, the new system increases customer satisfaction and brand recognition. Irwin offered six “no-regret activities” to ensure success:

• Transform the core: Digitalize and integrate engineering, production, and support for new efficiencies.

• Focus on experience and outcome: Create hyperpersonalized value to differentiate and lead in the market.

• Re-architect the new ecosystem: Customer expectations are changing rapidly, change your ecosystem to keep up. Assemble and refresh the right partners to drive innovation and new capabilities.

• Innovate new business models: Invent new revenue streams for new sources of value.

• Manage the wise pivots: Continually balance investment and resource allocation between the core and the new. Finally, “Build the workforce,” Irwin said. “Advance them into high-value activities. It’s good for them, the company and society.”