Much has already been written about how the COVID-19 pandemic is changing and will change our lives, the economic environment, and the companies we operate. We all see the impact in one way or another.

For some, it could be as simple as finding ways to be productive working from home. For others, however, the impact could be as severe as experiencing layoffs, as waves of evaporating orders ripple through the supply chain with tsunami-like implications on factory production, distribution and fulfillment, and supply and demand planning.

This tsunami-like impact can hit companies’ financial condition with equal intensity. Many companies’ senior financial leaders are accustomed to some level of turmoil as the pressures of financing and credit, cash-flow management, profitability achievement, and basic financial and managerial reporting are routine. For other than a relative few finance leaders whose businesses operate on the rough edge of business survival, however, the rapid and unplanned arrival of the pandemic created a requirement and an opportunity to execute financial management at another level.

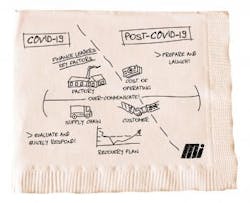

For CFOs in manufacturing and industrial distribution, the pandemic was a call to action–a call to quickly adjust and initiate new methods and guide business decision-making along paradigms that were, and in some ways still are, changing daily. Finance teams

Motion Industries' Greg Cook

that had been reporting on the steady performance of their businesses and factories are now building multi-scenario models of potentially dramatic sales downturns at decline rates previously unimaginable. Financial models and business plans which may have viewed breakeven as the implicit worst-case scenario are now being replaced by forecasts depicting partial or complete shutdowns.

These scenarios drive finance leaders to describe to their fellow leadership team the new harsh business realities of evaporating sales, dwindling cash collections, deferred capital improvement projects, underperforming capital investments, labor cost pressures, and unabsorbed operating costs. These new business realities have the potential to put the survival of the business in question, or at a minimum, force credit arrangements that will hamper the business for years to come.

With the harsh realities, however, comes opportunity. By clearly communicating the potential implications and financial ramifications of various pandemic responses, finance leaders can not only help minimize the long-term impact of the pandemic, but also help position their companies for the future–particularly a future that may never look like what had been planned before COVID-19. Finance leaders need to consider and actively manage a few key factors with their fellow operating leadership.

The factory floor

Refine factory production plans to maximize not just productivity but also overall cost containment and asset management. Consider aspects such as shutdown and start-up costs, downtime fixed costs, skilled associate retention risks, and capital investment returns, realizing that regarding the latter, some capital investments may now have significantly delayed payback periods or even face impaired value.

The supply chain

Adjust the supply chain to address the company’s key business risks. If dwindling cash collections are stressing the company’s solvency, operating at lower inventory and raw material safety-stock levels may become a priority and require an extra level of coordination throughout the production pipeline. On the other hand, companies with specialized supply chains or feedstock components may need to employ available cash to become the preferred customer of their suppliers by offering prompt payment.

The customer

Actively monitor and address dynamic customer conditions. Hardly any business is immune from being impacted in some way by the pandemic. Driving daily communication regarding customer order and payment trends can help businesses protect themselves–and the customers that matter–while exposing the customers that may be leveraging the pandemic to take advantage.

The cost of operating

Model the ongoing operating costs across the company. Certainly, cost reporting is a routine part of the responsibilities of finance, sometimes cynically viewed as the primary skill of finance. In the pandemic and post-pandemic environment, however, the finance function needs to clearly identify the types of costs and thresholds of spending that create pressure points on the health of the business and communicate those realities to their fellow operational leaders.

The recovery planGet with fellow operational leaders and write a recovery plan. Finance leaders in manufacturing and industry can help build the strategic actions the company will take not only to address the existing impact but also to prepare for and quickly launch out of the pandemic as soon as indicators allow. Finance leaders and company leadership must see through the pandemic to focus on the key strategic priorities toward which they were driving before the pandemic and must be committed to after the pandemic eases.

Model what those actions will look like in financial terms. Capture the key strategic actions that can maximize the recovery. Then, communicate it, prepare for it and rally the company’s associates around it. Just as the pandemic created a call to action for finance leaders, the recovery plan can be a call to action for a stronger recovery and a healthy business.

While managing through each of these factors, attempt to over-communicate. The quickly changing dynamics of the business environment create insight vacuums where, previously, financial information was already readily known or easily assumed. Finance leaders must accelerate and increase their communication about the company’s financial conditions and performance to prevent the less-than-optimal decision-making that might occur in those vacuums.

Financial leaders are accustomed to the routine pressures of their responsibilities, but the pandemic has hit many with new and real intensity. This unprecedented environment has created both a requirement and an opportunity to execute financial management at another level. Finance leaders can capitalize on that opportunity to guide their companies through the pandemic and toward a successful recovery.

Greg Cook is EVP & CFO with Motion Industries