Profitable servitization & service-based revenues

By Marne Martin, IFS president of service management

Servitization can be an extremely lucrative model for manufacturers. According to McKinsey, manufacturers can see earnings-before-interest-and-taxes of at least 25% on services while margin on new sales is often only 10%. Let's explore the key steps manufacturers need to take to deliver profitable servitization services and determine how they can leverage technology to maximize aftermarket profits.

IFS' Marne Martin

Aftermarket services have become a popular way for manufacturers to add value to products and a measure of their competitive advantage to their peers. Service offerings, such as a warranty and break-fix/depot repair are evolving into service contracts that often include some service level agreement (SLA) for response time, mean time to repair, total uptime or other metrics either related to obligations or outcomes.

As a result, manufacturers are realizing more revenue after the sale—and are reaping the rewards of aftermarket-revenue margins that can be much larger than the original product sale over the lifecycle of the equipment in question.

Although some manufacturers have already started this journey, most have a long way to go to achieve full servitization, where service has become the product. It is essential that organizations turn to a capable enterprise resource planning (ERP) solution that can extend manufacturing functionality to address the rest of the product lifecycle, including aftermarket operations, revenue and margin, rather than only the more traditional finance, CRM and HR use cases that don’t help a manufacturer to servitize at the same pace.

Step one: Servitization begins with aftermarket products

For organizations that currently do not offer any type of service, achieving full servitization may seem intimidating, given the business model change. But there are steps these manufacturers can take to gradually introduce service into their business models—and a flexible ERP solution should be able to assist every step of the way.

Offering warranties and spare parts is typically the entry level of servitization. Although these steps may seem simple, without implementing sufficient complementary software, this area of the business will fail to be profitable and could even threaten the profitability of existing production. In fact, putting profitable aftermarket service in place requires manufacturers to plan operations to cover initial production as well as aftermarket sales of both the assets and parts. It also requires a change in thinking where assets and parts are manufactured with aftermarket service in mind.

A supporting software platform should manage service obligations and inventories, monitor the supply chain for parts, and give customers a portal to order these products. Choosing an ERP platform that facilitates the broader servitization journey, even if the focus is on warranties and selling parts, will help lay the foundation for additional services in the future and generate data that enables manufacturers to understand their customers’ needs in enhanced ways.

Step two: Secure profits with service contracts

The next step is annual maintenance or service contracts, which results in much more stable, predictable revenue and margin—and is in fact what customers prefer as they also have security and peace of mind to know their asset purchase is a safe investment. Manufacturers can offer a reactive service to customers—performing work on a break-fix basis either in the field or in a depot—but the revenue is harder to predict and the margins much tighter, plus customers ideally don’t want something to break before technicians come to fix it.

By selling a contract based on insights and results rather than a reactive service, manufacturers create a planned-revenue stream, and the contract can be priced with a margin baked in. This makes the service department a solid profit center that can drive both top-line growth and profits. A recent IFS survey of 200 industrial executives found manufacturers involved in planned maintenance or service contracts were more likely than other respondents to report service as a profit center, with 62% reporting profitability.

To ensure a contract is profitable, manufacturers need an ERP with tools for intelligently pricing contracts based on historical or projected costs. Contract-management embedded into an ERP platform allows manufacturers the flexibility to execute against multiple contract types—from simple time-and-materials contracts to fully inclusive 24-7 contracts for customers that need service availability around the clock.

Step three: Take the service relationship further—tailor contracts to customer needs

Contracts can also be structured with what the customer wants as an outcome or to start SLAs designed around customer needs. This allows manufacturers to price around the value they create rather than the number of service calls performed. Tools are needed to price agreements competitively, while protecting margins and balancing revenue over the product lifecycle. Manufacturers will gain the ability to quickly structure contracts according to customer-specific requirements or as negotiated to be flexible to changing business needs or competitive realities. Contracts can then be quickly operationalized, ensuring service is delivered to meet these expectations.

Apart from increased profitability, effective service contracts enable organizations to become long-standing, strategic partners with their customer base at a time when the service provided is at least as important as the quality of the asset manufactured. When an organization can guarantee a required level of service at a known cost to meet a specific outcome, customers can offload some responsibility to the service provider. For organizations, that deeper, trusting relationship means customers are less likely to move their service contracts to a competitor, and helps them win net new customers.

Step four: Take the leap to full servitization

Some manufacturers have moved well beyond selling a product with aftermarket service to full servitization—selling the product’s output or performance over the life of the product instead of selling the product itself. Some manufacturers or utilities have led the way selling kilowatt hours instead of power-generation turbines, or hours of use. Proactive service and engineering a product for total lifecycle cost are critical success factors for developing a profitable service offering at this level.

It’s also important for organizations to have the ability to account for and make decisions based on the total through-life cost, and productivity of an asset to know when to re-price a service contract or make an offer to the customer for a new asset.

For manufacturers to servitize they must have from a software vendor the capabilities and expertise to visualize and operationalize advanced outcome-based business models, which requires data and operational-intelligence software, in order to formalize these models into customer contracts and then profitably fulfill the contract.

Success hangs on service-optimized software

Manufacturers intent on servitization have the opportunity to manage service both as an operational discipline and as a profit center. A standard ERP application used in a manufacturing environment will not be able to adequately handle aftermarket service revenue, as it is built primarily around the product/sale transaction, which is why so many manufacturers who chose an ERP for the finance or HR package have struggled to monetize service and grow their competitive advantage.

Servitization requires much more, including contract and warranty management, artificial intelligence (AI)-driven schedule optimization, and what-if scenario-planning features to ensure manufacturers can track the success of their servitization journey.

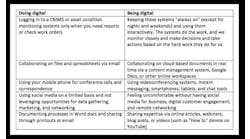

Transformative technologies such as AI, machine learning, augmented or merged reality, and the Internet of Things are also essential for streamlining service operations for manufacturers and should be rooted in the service-optimized ERP platforms they choose. IoT-enabled devices can provide organizations with condition-based maintenance data, while AI and machine learning can optimize and drive productivity in key areas of a service operation, including scheduling, inventory management and customer interaction, with augmented or merged reality helping to provide remote service or help technicians be more productive.

Let servitization put you ahead of competition

Servitization can deliver reliable revenue and margin that some manufacturers may be sorely needing. It can position companies as leaders in their segments.

Wherever organizations are on their servitization journey, they will need an enterprise system capable of handling their current processes, as well as those they may adopt in the future. Only then will they be able to move into these new and lucrative areas without undue opportunity costs.